Most standard homeowners insurance policies offer limited coverage for mold damage, but the extent of protection varies significantly between insurers and policy types. According to the Insurance Information Institute, approximately 22% of all homeowners insurance claims are related to water damage and freezing, which can often lead to mold issues.

Insurance coverage for mold typically falls into three main categories:

- Sudden and Accidental Coverage: This most common type covers mold damage resulting from unexpected events like burst pipes, accidental appliance overflow, or firefighting water damage. For example, if your washing machine hose suddenly bursts and causes water damage that leads to mold, your policy would likely cover both the water and subsequent mold damage.

- Named Peril Coverage: Some policies only cover mold damage when it results from specifically listed perils in your policy. Industry experts at the National Association of Insurance Commissioners report that these typically include storms, lightning strikes, and other natural disasters.

- Endorsements or Riders: Many insurance companies offer additional mold coverage through special endorsements. These add-ons typically provide $10,000 to $50,000 in extra coverage for mold remediation, though costs can vary by region and provider.

Recent data from remediation specialists indicates that the average mold damage claim ranges from $15,000 to $30,000, making it crucial for homeowners to understand their coverage limits. Some insurers have begun offering “limited fungi coverage,” which typically provides between $1,000 and $10,000 for mold-related damages.

Insurance experts recommend carefully reviewing your policy’s declaration page and discussing coverage options with your agent. According to a 2022 survey by the National Association of Realtors, approximately 30% of homeowners discovered they had insufficient mold coverage only after experiencing a problem.

For comprehensive protection, insurance coverage specialists suggest considering an umbrella policy or additional endorsements if you live in a high-humidity area or have an older home more susceptible to water issues. These supplemental policies typically add $200-500 to annual premiums but can provide crucial protection against expensive mold remediation costs.

Common exclusions and limitations

While homeowners insurance can provide protection against mold damage, it’s crucial to understand the significant exclusions and limitations that commonly apply. Most policies explicitly exclude mold damage resulting from long-term exposure to moisture, poor maintenance, or neglect. Insurance coverage typically won’t extend to situations where the homeowner could have prevented the mold growth through routine maintenance or timely repairs.

Another major limitation involves pre-existing mold conditions. Insurance companies generally refuse coverage for mold that was present before the policy’s effective date. Additionally, many policies impose strict dollar limits on mold-related claims, often capping coverage at $5,000 to $10,000, even when the actual remediation costs may be substantially higher.

Flood-related mold damage presents another significant exclusion. Standard homeowner policies don’t cover mold resulting from flooding, requiring separate flood insurance for such protection. Similarly, mold damage arising from humidity, seepage, or construction defects typically falls outside standard coverage parameters.

Many insurance providers have also implemented “anti-concurrent causation” clauses, which means if an excluded peril contributes to mold damage alongside a covered peril, the entire claim might be denied. For example, if a covered pipe burst combines with excluded poor ventilation to cause mold growth, the insurer might deny the entire claim.

- Mold damage from gradual water leaks or seepage is typically excluded from standard policies

- Coverage limits for mold claims often range from $5,000 to $10,000, regardless of actual remediation costs

- Most policies exclude mold resulting from homeowner negligence or lack of maintenance

- Pre-existing mold conditions are universally excluded from coverage

Factors affecting mold damage claims

Several key factors determine whether an insurance company will approve a mold damage claim and the extent of coverage provided. Understanding these elements can help homeowners maximize their chances of claim approval and adequate compensation.

The timing of discovery and reporting plays a crucial role. Insurance companies typically require immediate notification of water damage or mold discovery. Delays in reporting can lead to claim denials, as insurers may argue that the delayed response contributed to increased damage. According to insurance coverage specialists, homeowners should document and report potential mold issues within 24-48 hours of discovery.

The source and cause of mold growth significantly impact claim decisions. Insurers carefully evaluate whether the mold resulted from a sudden, covered event or developed due to ongoing maintenance issues. For example, mold damage from a burst pipe is more likely to be covered than mold growing due to chronic bathroom ventilation problems.

Documentation quality substantially affects claim outcomes. Successful claims typically include:

– Detailed photographs of the affected areas

– Professional inspection reports

– Maintenance records showing regular home upkeep

– Records of previous water damage repairs

– Estimates from licensed mold remediation specialists

Property maintenance history is another critical factor. Insurance companies examine whether the homeowner maintained proper:

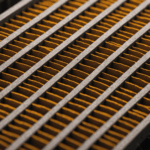

– Ventilation systems

– Humidity levels

– Plumbing infrastructure

– Roof and foundation integrity

The geographic location and climate can influence claim decisions. Homes in high-humidity regions often face stricter scrutiny, and insurers may require evidence of additional preventive measures. Some policies include specific requirements for homes in moisture-prone areas.

Pre-existing conditions and home age also affect claims. Older homes or those with previous mold issues may face more stringent review processes. Insurance companies often require more detailed documentation and may impose higher deductibles for such properties.

The scope and extent of mold contamination impact coverage decisions. While minor infestations might receive straightforward approval, extensive mold damage often triggers more thorough investigations and may require multiple professional assessments before claim approval.

Amount of coverage available also depends on policy history. Previous mold-related claims can affect current coverage limits and may result in higher deductibles or more restricted coverage options for future claims.

Prevention and maintenance requirements

Regular maintenance and proactive prevention are crucial for protecting your home from mold damage and maintaining insurance coverage eligibility. Start by conducting monthly inspections of areas prone to moisture, such as bathrooms, basements, and around windows. Industry experts recommend maintaining indoor humidity levels between 30-50% using dehumidifiers and proper ventilation systems.

Essential preventive measures include:

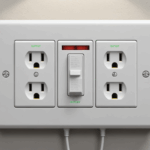

– Installing and maintaining proper ventilation in bathrooms, kitchens, and laundry rooms

– Promptly repairing any plumbing leaks or water damage within 24-48 hours

– Ensuring proper drainage around your home’s foundation

– Regular cleaning and maintenance of gutters and downspouts

– Using mold-resistant products during home repairs or renovations

Many insurance providers require specific maintenance documentation to validate claims. Keep detailed records of:

– Regular HVAC system inspections and filter changes

– Professional plumbing inspections

– Roof maintenance and repairs

– Humidity level monitoring

– Water damage remediation efforts

Homeowner advice from insurance specialists emphasizes the importance of installing water detection devices near high-risk areas. These smart devices can alert you to moisture problems before they lead to mold growth, potentially saving thousands in remediation costs and protecting your insurance coverage.

Professional home inspections should be conducted annually, focusing on:

– Foundation integrity

– Roof condition and attic ventilation

– Plumbing system functionality

– Window and door seals

– Basement waterproofing

Insurance companies often provide premium discounts for homes with preventive measures in place. Consider implementing:

– Automatic water shut-off systems

– Smart moisture sensors

– Backup sump pumps

– Professional-grade dehumidification systems

By maintaining proper documentation and following these preventive measures, you’ll not only protect your home from mold damage but also strengthen your position should you need to file an insurance claim. Being proactive about maintenance isn’t just about protecting your investment—it’s about ensuring your family’s health and maintaining your home’s value for years to come.

Steps to file a mold-related insurance claim

- How quickly do I need to report mold damage to my insurance company?

- Insurance providers typically require notification within 24-48 hours of discovering mold or water damage. Prompt reporting is crucial for claim approval, and delays could result in denial of coverage.

- What documentation do I need when filing a mold damage claim?

- You’ll need detailed photographs of the affected areas, professional inspection reports, and estimates from licensed mold remediation specialists. It’s also important to maintain records of regular home maintenance and any previous water-related repairs.

- Will my insurance rates go up if I file a mold claim?

- Filing a mold-related claim may impact your insurance rates and future coverage options. Insurance companies typically consider your claims history when determining premiums, and multiple mold claims could result in higher rates or reduced coverage.

- Can I handle the mold cleanup myself to save money on the claim?

- Insurance coverage often requires professional remediation services for mold damage claims. DIY cleanup attempts could void your coverage and potentially worsen the situation, leading to denied claims or reduced settlements.

- What happens if my claim is denied, but I believe it should be covered?

- You can appeal the decision by providing additional documentation or hiring a public adjuster to review your case. Many insurance providers have formal appeals processes, and you may also seek legal counsel if necessary.